Understanding Ship Tonnage: How Measurement Laws Shaped Global Maritime Trade

How were ships measured and taxed? This 1920 guide explains the laws behind ship tonnage measurements, including Gross, Net, Deadweight, Displacement, and Cargo Tonnage. Discover how these regulations shaped international trade, port fees, and maritime history!

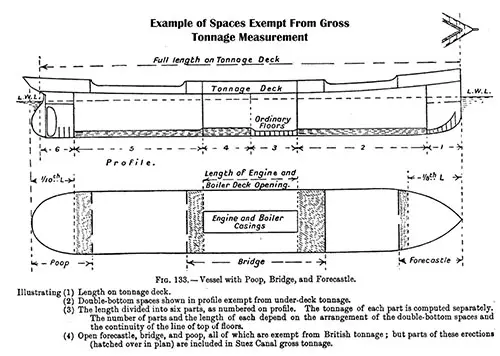

Fig. 133. — Vessel With Poop, Bridge, and Forecastle. Illustrating (1) Length on Tonnage Deck. 2. double-Bottom Spaces Shown in the Profile Are Exempt From Under-Deck Tonnage. 3. the Length Is Divided Into Six Parts, As Numbered on the Profile. The Tonnage of Each Part Is Computed Separately. the Number of Parts and the Length of Each Depend on the Arrangement of the Double-Bottom Spaces and the Continuity of the Line of Top of Floors. 4. open Forecastle, Bridge, and Poop, All of Which Are Exempt From British Tonnage, but Parts of These Erections (Hatched Over in Plan) Are Included in Suez Canal Gross Tonnage. Know Your Own Ship, 1918. | GGA Image ID # 220909f7a1. Click to View a Larger Image.

Introduction

The article "Measurement and Tonnage Laws," published in 1920, provides a detailed overview of the legal framework governing the measurement of ship tonnage, a crucial factor in maritime operations. It explains how tonnage is calculated and the significance of these measurements in determining port fees, shipping regulations, and the overall classification of vessels. The article also explores the historical development of these laws and their application in international shipping practices.

Measurement of vessels: On May 6, 1864, Congress passed an act that practically adopted the gross tonnage measurement system established in Great Britain by the Merchant Shipping Act of 1854.

The act of 1864 was amended by the act of February 28, 1865, which provided (Rev. Stat. 4151) that no part of any vessel used for cabins or staterooms and constructed entirely above the first deck which was not a deck to the hull, should be required to be measured or registered for tonnage.

This amendment was drafted particularly for coastwise, lake, and river steamers but also applied to ocean steamers.

Tonnage Statutes

According to the interpretation made by the United States Customs Regulations of 1908 (Articles 71-87), this amendment "was designed merely to exclude cabins and staterooms above the promenade deck of the steamers of the seacoast and lakes, or above a boiler deck as used on the western rivers. It does not have the effect of exempting from admeasurement any closed-in place even if so situated if used for cargo and stores."

The act of 1864 provided only for the ascertainment of gross tonnage, and until 1882, this formed the basis upon which tonnage taxes and ship charges were levied at American ports.

In 1882, the United States Measurement Act adopted the Danube Rule, which, in the case of most ships, made a smaller allowance for propelling power, including fuel, than the British Act.

The act of 1882 was superseded by the Frye Measurement Act of March 2, 1905, which adopted the British rules for measuring propelling power for the United States, bringing our measurement laws into accord with prevalent maritime practice. On February 6, 1909, another act dealing with tonnage was passed.

Under present United States laws, regulations, and interpretations, the tonnage basis for charges on an American ship does not exceed that on a foreign vessel and, in some cases, is materially less.

Rules of Measurement

The United States gross tonnage rules include in the measurement the entire space under the tonnage deck and between the tonnage and upper decks; the space occupied by hatchways over one-half of one percent of the vessel's gross tonnage, exclusive of the hatchway tonnage; and any permanent closed-in space on the upper deck available for cargo or stores or for the berthing or accommodation of passengers or crew.

Under the law of 1865, however, as has been stated, certain passenger decks are not subject to gross tonnage measurements.

Nine different spaces are exempt from gross tonnage measurement. They are:

- Double-bottom water-ballast spaces are not available for stores or hulls, and the spaces between the frames and the floor beams.

- Spaces under the shelter deck and in the poop, forecastle, and bridge when not permanently closed in.

- Passenger accommodations in tiers of superstructures over the first tier above the upper deck.

- Hatchways up to one-half of one percent of the vessel's gross tonnage.

- Galleys, bakeries, toilets, and bathhouses above deck.

- Spaces above the deck occupied by the ship's machinery or for the working of the vessel.

- Light, air, and funnel space over the engine and boiler room and above the upper or shelter deck.

- Domes and skylights, companionways (except portions used as smoking rooms), and ladders and stairways in exempted places.

- Open spaces occupied by deck loads.

American Tonnage Rates

Tonnage Duties: These are a general charge or tax on shipping and are closely related to the measurement of vessels. Practically all countries levy them.

In the United States (Rev. Stats. 427, amended by sec. 36, act of August 5, 1909), a tonnage tax at the rate of two or six cents for each net ton is levied upon every vessel engaged in trade upon arrival by sea from a foreign port. Ships in distress are exempted.

The two-cent-a-ton rate applies to all vessels arriving from any foreign port in North America, Newfoundland, Central America, the West Indies, the Bahamas, and Bermuda, or the coast of South America bordering on the Caribbean Sea.

The six-cent a-ton covers all vessels arriving from any other foreign port. The tonnage duty is not levied on more than five entries at the same rate during any one year, the tonnage year beginning with the date of the first payment and ending on the day preceding the corresponding day in the following year.

United States tonnage rates are about the same as the light dues imposed in Great Britain. They are considerably lower than those levied in the ports of Continental Europe and elsewhere.

United States laws make various exemptions from the payment of tonnage duties. These primarily affect the fisheries and the Great Lakes vessels.

Bibliography

Bankers Trust Company, "Chapter XXIII: Measurement and Tonnage Laws," in America's Merchant Marine: A Presentation of Its History and Development to Date with Chapters on Related Subjects, New York: Bankers Trust Company, 1920, pp. 183-185.

Thomas Walton, Know Your Own Ship: A Simple Explanation of the Stability, Trim, Construction, Tonnage, and Freeboard of Ships,.together With a Fully Worked Out Set of the Usual Ship Calculations (From Drawings). Specially Arranged for the Use of Ships’ Officers, Superintendents, Engineers, Draughtsmen, and Others. Fourteenth Edition. Revised by John King. London: Charles Griffin and Company, Limited, 1918.

📏 Measurement and Tonnage Laws: A Comprehensive Guide for Maritime Historians, Teachers, and Researchers 🚢

📜 Recap & Summary: Understanding the Legal and Historical Significance of Ship Tonnage

The article "Measurement and Tonnage Laws" (1920) provides an in-depth look at the complex legal framework governing ship tonnage measurement, an essential aspect of maritime operations. It examines historical tonnage laws, different methods of measurement, and how these classifications impacted port fees, taxation, and international shipping regulations.

For teachers and students, this article serves as an excellent resource on maritime history, naval architecture, and international law. For genealogists, it helps interpret passenger ship records and migration statistics. For maritime historians and ship enthusiasts, it explains how ships were classified and measured based on evolving global tonnage laws.

🔎 Why This Article is Essential for Different Audiences

📖 For Teachers & Students

- Real-World Math & Engineering – Demonstrates how tonnage calculations influence ship design and cargo capacity.

- History & Law – Provides a historical timeline of tonnage regulations and their impact on global shipping trade.

- Economics & Global Trade – Explains how tonnage laws affected port fees, international taxation, and maritime commerce.

🧬 For Genealogists & Passenger Researchers

- Interpreting Passenger Manifests – Understanding tonnage helps explain the capacities of passenger ships during mass migrations.

- Historical Ship Records – Provides context for ship classifications in immigration and travel documents.

⚓ For Maritime Historians & Ship Enthusiasts

- Ship Design & Measurement – Discusses how tonnage impacted shipbuilding, naval architecture, and trade classifications.

- Legal Evolution – Explores the international agreements that standardized tonnage measurements.

- Port & Canal Fees – Examines how different tonnage laws influenced tariffs, taxation, and access to ports and canals.

⚖️ Key Topics Covered: The Evolution of Ship Tonnage Laws

📜 1. Historical Development of Tonnage Measurement

The Merchant Shipping Act of 1854 (UK) and the United States Tonnage Laws of 1864 & 1865 played crucial roles in shaping modern measurement rules.

The 1882 Danube Rule & Frye Measurement Act (1905) brought American regulations in line with British laws, standardizing the deduction of engine room spaces.

🔍 Why It’s Important: This timeline provides a clear evolution of maritime law, helping researchers understand why ships were measured differently over time.

📏 2. Different Tonnage Measurement Methods & Their Impact

⚖️ Gross Tonnage (GT)

Measures the total enclosed volume of a ship, including crew and passenger spaces.

Used for international trade statistics, ship classification, and government regulations.

📦 Net Tonnage (NT)

Represents the actual cargo space available after deducting engine rooms, fuel storage, and accommodations.

Used for port fees, canal tolls (Panama & Suez), and trade tariffs.

🛳️ Deadweight Tonnage (DWT)

Measures the maximum carrying capacity of a vessel, including cargo, fuel, stores, and passengers.

Crucial for freight shipping and bulk cargo calculations.

⚓ Displacement Tonnage

Measures the total weight of the ship and its contents based on water displacement.

Primarily used for naval vessels and stability calculations.

📊 Cargo Tonnage

Indicates the total amount of cargo a ship can carry.

Calculated in weight tons (2,240 lbs) or measurement tons (40 cubic feet per ton).

🔍 Why It’s Important: Understanding these classifications helps maritime researchers, engineers, and economic historians analyze shipping trends and trade policies.

📜 3. Rules & Exemptions in Tonnage Calculations

Nine types of spaces were exempt from tonnage measurements, including:

✅ Double-bottom ballast spaces (not available for cargo).

✅ Open spaces in the poop, forecastle, and bridge.

✅ Crew accommodations in certain superstructures.

✅ Engine and boiler rooms.

✅ Skylights, ladders, and stairways.

✅ Deck spaces used for ship operations (e.g., steering, navigation, or ventilation).

🔍 Why It’s Important: These exemptions played a major role in determining ship taxes, port fees, and international trade laws.

⚓ 4. Tonnage Laws & International Maritime Trade

Tonnage duties (taxes) varied based on ship measurements.

The US imposed a tax of 2 to 6 cents per ton on ships arriving from foreign ports.

Canal tolls (Suez & Panama) were based on net tonnage, often leading to disputes between shipowners and port authorities.

The House of Representatives (1919) proposed new rules based on actual cargo capacity instead of net tonnage, influencing how ships were taxed.

🔍 Why It’s Important: This section explains how tonnage laws influenced global shipping costs, taxation, and maritime economics.

📸 Noteworthy Images & Diagrams

🖼️ "Fig. 133 – Vessel with Poop, Bridge, and Forecastle"

✅ Shows how ship tonnage is divided and measured based on deck arrangements.

✅ Highlights which sections of a ship were included or excluded in tonnage calculations.

🌍 Global Impact of Tonnage Laws on Trade & Shipping

🚢 Shipbuilding & Engineering – Tonnage laws directly impacted ship design, ensuring compliance with regulations.

💰 Economic & Trade Policies – International tonnage agreements affected shipping costs, taxation, and import/export regulations.

⚖️ Legal & Government Oversight – National governments used tonnage laws to enforce maritime safety, trade agreements, and naval construction standards.

By examining how ships were classified based on these laws, we gain a better understanding of global trade and maritime infrastructure development.

📚 Additional Reading & Resources

📖 "Cargo and Carrying Capacity of Ships" – How cargo space was optimized for trade.

📖 "How a Ship’s Gross Tonnage is Computed" – A deep dive into tonnage calculation formulas.

📖 "Net Tonnage of a Vessel and Its Computation" – How net tonnage affected trade and taxation policies.

These references provide further insight into the evolution of ship measurement techniques and international maritime laws.

🔚 Final Thoughts: Why This Article is Essential

This detailed guide to ship tonnage laws provides a rare look at early 20th-century maritime regulations and their impact on global trade.

🌎 For historians – Explains how different nations classified ships, influencing trade laws and commerce.

📜 For genealogists – Helps interpret passenger ship records and migration data.

🚢 For ship enthusiasts – Offers insights into naval architecture, ocean travel, and maritime taxation.

This essential resource remains invaluable today, helping researchers understand how ship measurements, laws, and economic factors shaped maritime history. 🌊⚓